The IRS Writes Off Millions In Tax Debt - See If You Qualify For Tax Relief.

Which Best Describes Your Current Situation?

I owe business/personal taxes

I have tax levies/liens

I'm dealing with wage garnishment/asset seizure

I'm filing returns for the unfiled years

We're Looking To Help Anyone Who's Suffering With Taxes From The IRS!

- Tax Levies & Liens

- Resolve Back Taxes

- Wage Garnishments

- IRS Audit Defense

- Asset Seizures

- Tax Preparation

- Reduce IRS Tax Debt

- Payroll Tax Negotiation

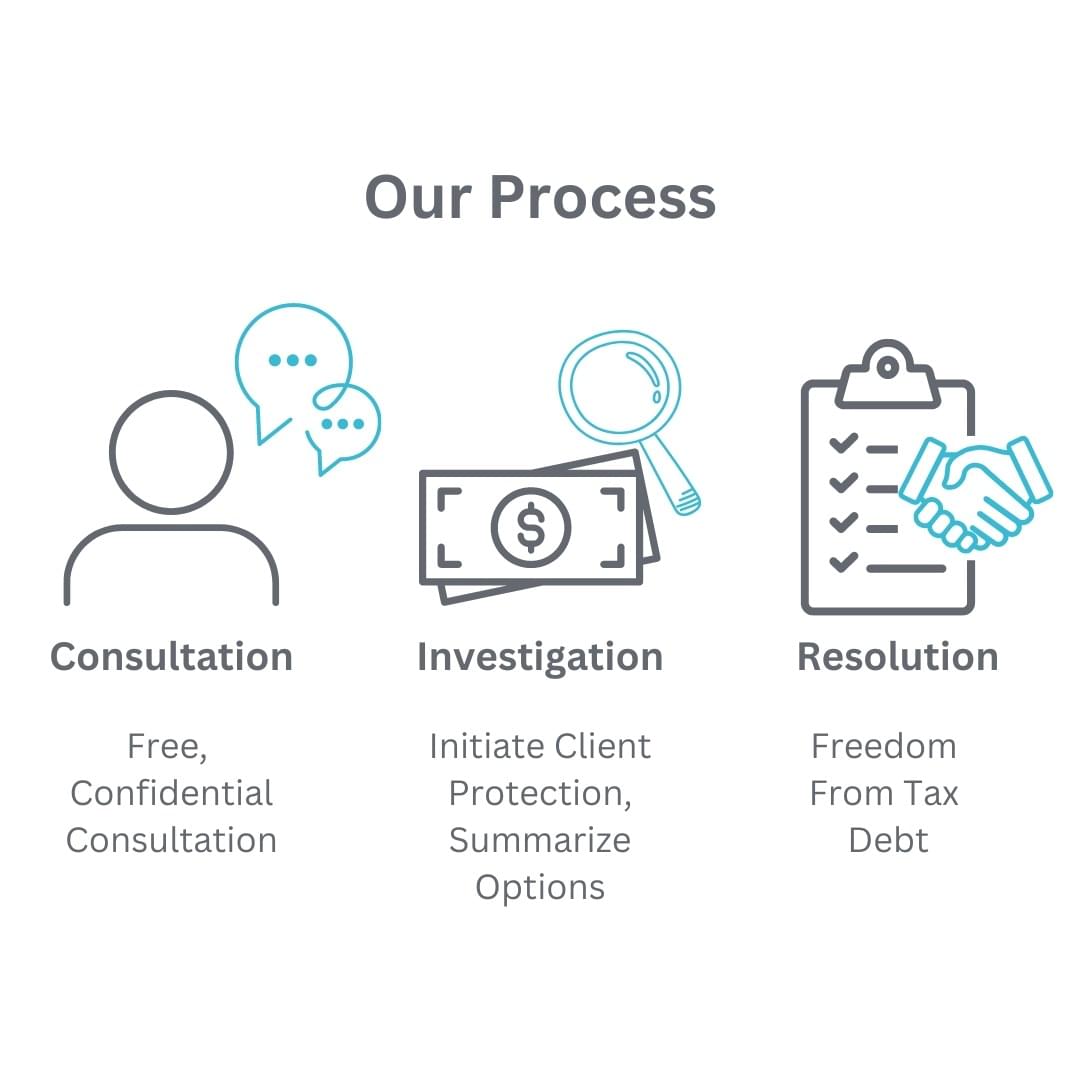

Our Process

Consultation

Free, Confidential Consultation

Investigation

Initiate Client Protection, Summarize Options

Resolution

Freedom From Tax Debt

Our clients

Our Accreditation

We Are an A BBB Accredited Business

Member of the National Association of Enrolled Agents

Licensed by the IRS to Practice in All 50 states

Approved Continuing Education Provider